Hey friend,

Happy new year and welcome to the first KlientBoost Kitchen newsletter of 2026!

I hate to start us off on a negative foot, but after analyzing 50+ ad accounts last year, I'm worried too many marketers will repeat the same mistakes in 2026.

And that’s jumping straight to tactics when really what works is getting the house in order first.

So, that's what this newsletter is going to focus on.

I want to share some real advice on how to get your paid ad program foundations solid to set you up for success this year.

After running this playbook across our accounts (and our clients), here's the recipe I recommend to get serious ROI from your paid program in 2026.

Don’t Spend Anything Until Your House Is In Order

If you run a paid program right now (or it’s in the roadmap to launch one), I really recommend you check the foundations before throwing a heap of money at it this year.

Most teams skip straight to creative and wonder why nothing converts. But after 8 years in performance marketing, I still see (🫠) the same mistakes over and over that tank paid programs 👇

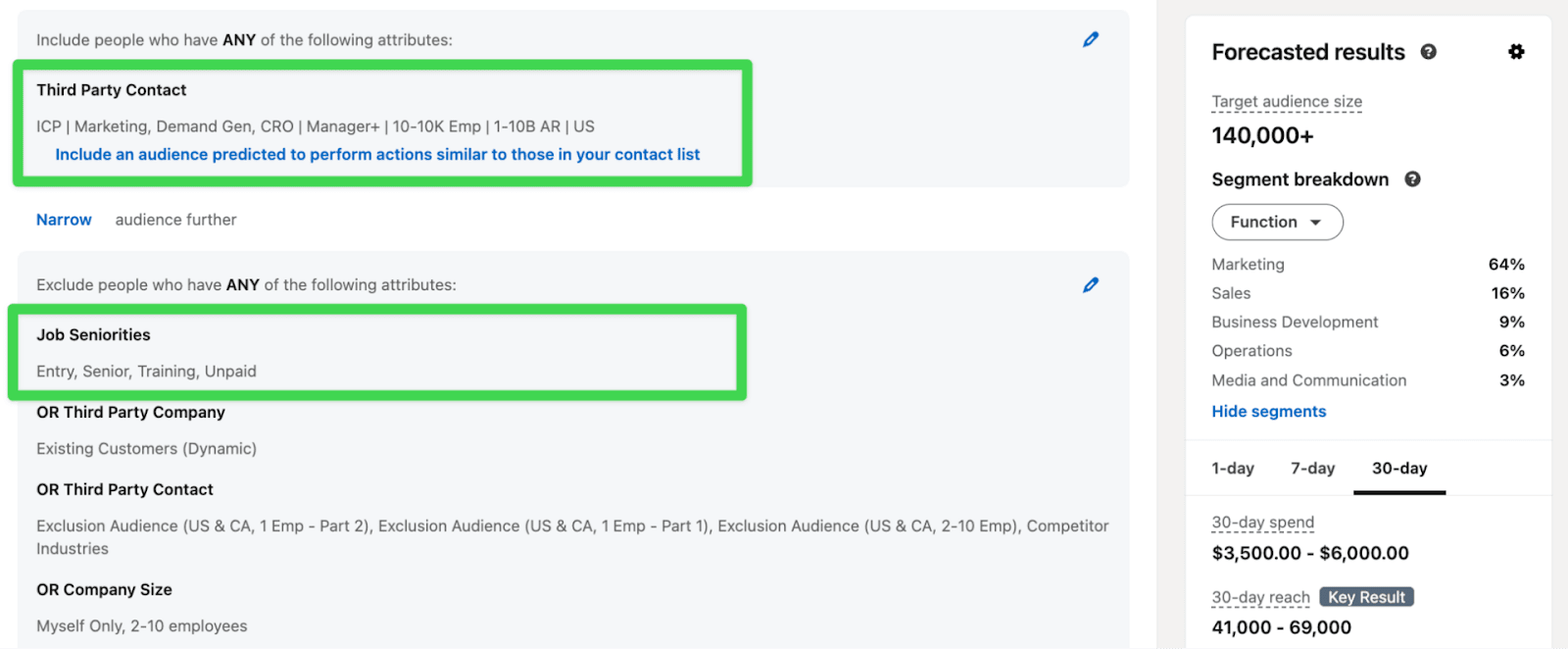

1. Targeting

I audited multiple accounts last year targeting 1m+ audience sizes. Unless you have millions to spend, no scaling B2B can afford to target this amount of people effectively.

What I recommend is to use a tool like Primer or Clay to build company lists based on your actual ICP data—not LinkedIn's suggestions of who you should target. LinkedIn's native targeting is fine, but it's also flawed and can waste spend.

What works better is building a list of companies that match your ICP and sending that into the platform. It's going to be much more accurate.

Here’s how it works:

Build an audience filtered by exact job titles. I use Primer for this and then use the audience lists not just on LinkedIn but on Google and B2C channels (win, win)

Upload to Campaign Manager. Pull this data in as as a matched audience

Add seniority filters. Include titles like Director, Manager, VP, CXO, Owner (whoever is the decision-maker within your target segment)

Add seniority exclusions. Exclude anyone who doesn’t have buying decision power (target non-management roles with keywords like Entry, Training, Unpaid, and Senior)

This is a real campaign of ours that uses third-party data from Primer to tighten up audience targeting.

Then, push 80% of spend to proven segments (accounts that match existing closed/won profiles), and use the remaining 20% for testing new segments.

The reason I recommend this split is a lot of companies come into the new year without a budget increase, but they get requests from the sales team or CEO to start targeting new segments.

If you don't have additional budget for that, what happens is budget is pulled away from segments that are definitely going to generate pipeline and put it into segments that are not definitely going to generate pipeline.

That makes it much harder to hit pipeline goals (which usually have gone up as well).

2. Messaging

This is still (in my opinion) one of the biggest problems in B2B marketing. A lot of companies talk about what they want to talk about, not what their prospects care about.

If you prioritize a clever tagline over just a really clear tagline, that’s the first place I would start to fix low-performing messaging. It’s always better to explain as clearly as possible exactly the problem you solve, who you solve it for, and how you solve it.

Here’s a quick way to tighten up your ad messaging:

Pull first-call transcripts from your last 12 months of closed/won deals

Use a tool like Claude or ChatGPT to do the heavy lifting. Load the transcripts into a chat with this prompt:

This will identify top pain points, exact customer quotes and the emotional driver (fear, frustration, uncertainty) that drove people to jump on a call with you.

Finally, drop these pain points into a Google Sheet and build out your POV as a company: What are their biggest problems, and what solution do you bring to the table?

Real messaging we use at KlientBoost based on this strategy.

That’s your ad copy for 2026.

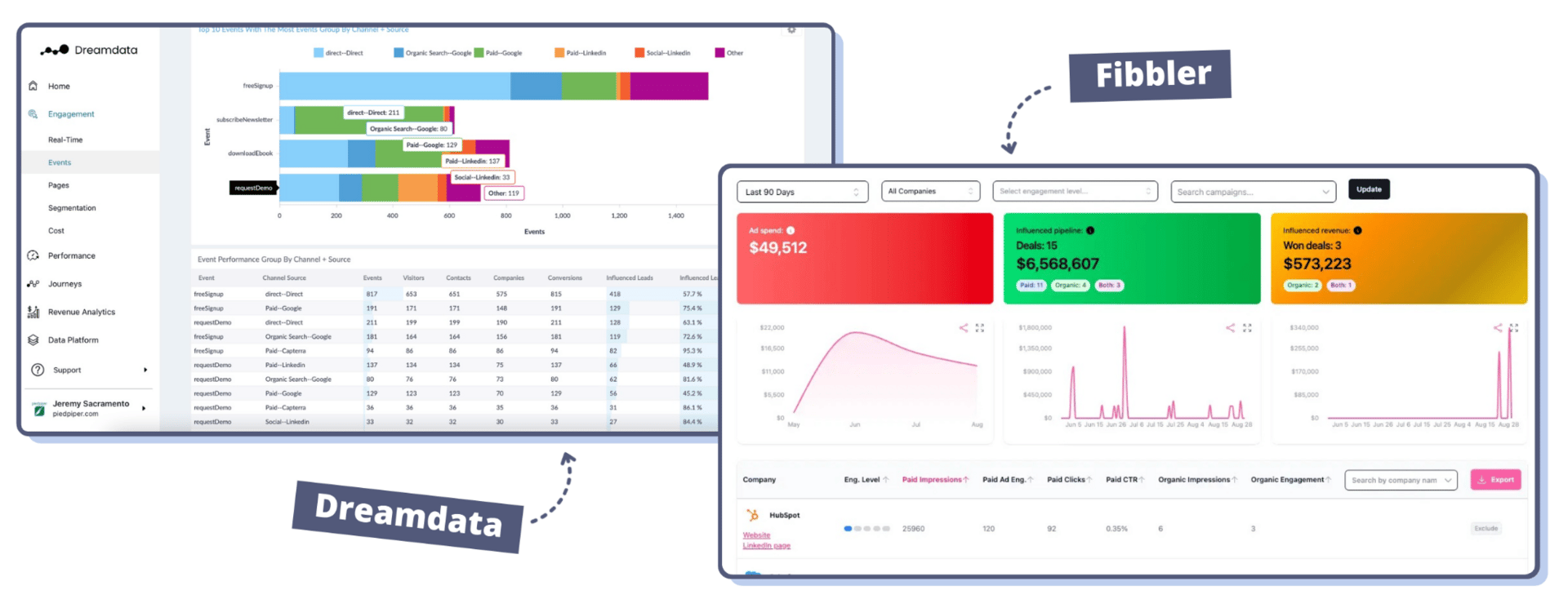

3. Attribution + Tracking

Set up multi-touch attribution to capture full buyer journeys and measure influence of each channel on deals.

We use Dreamdata, which can analyze a lot of channels and connect to review platforms like Capterra and G2 to give you a deep understanding of buyer journey across multiple touchpoints. I also recommend Fibbler, which specializes in LinkedIn Ads and is developing Google Ads and Meta Ads attribution.

Attribution tools are so valuable that I actually recommend our clients pull a portion of paid ad budget and reallocate it there if they aren’t already using one.

The reasons why are important:

Last-click attribution misses 90% of what influenced the deal. B2B SaaS buyers now touch 70+ interactions across an average of 7 stakeholders before they close. If you only credit the last ad click, you'll never understand what truly works in your paid program

Journeys are long. I now recommend viewing journeys through a longer window to clients (365 days for LinkedIn and 90 days for Google) to really understand how buyers are moving. If you don’t take a longer view, you miss all of the influence these channels have on your pipeline

Self-reported attribution is tricky. Not every business is going to be able to pull this off depending on alignment with the sales team. But even if you can just get that for closed/won deals, it’ll be really valuable

Just keep in mind there's definitely some recency bias to self-reported attribution.

Prospects put a higher weight to the touchpoints they viewed recently, which is good to know because then you know which touchpoints work best for in-market prospects.

But, it's not necessarily going to tell you what's building trust earlier in the buying journey.

Think About What House(s) You Want To Live In

Most B2Bs focus on Google and LinkedIn to find their audiences, and I don’t see anything changing in 2026.

What I do still anticipate is orgs using these platforms the wrong way. The usual mindset is to come up with a generic figure around how much to spend on LinkedIn and Google, like $20k/month on Google and $5k/month on LinkedIn.

The right way to approach budget allocation is to figure out where you have maxxed out your audience, and where there is room to scale.

For Google, check search impression share in your campaigns:

If it’s under 10%, you must scale budget. You only show up 10% of the time, which means there's loads of room to scale in a way that continues to scale pipeline.

Over 90%? You've maxed out search demand, and any additional spend you put into the platform probably won't even get used.

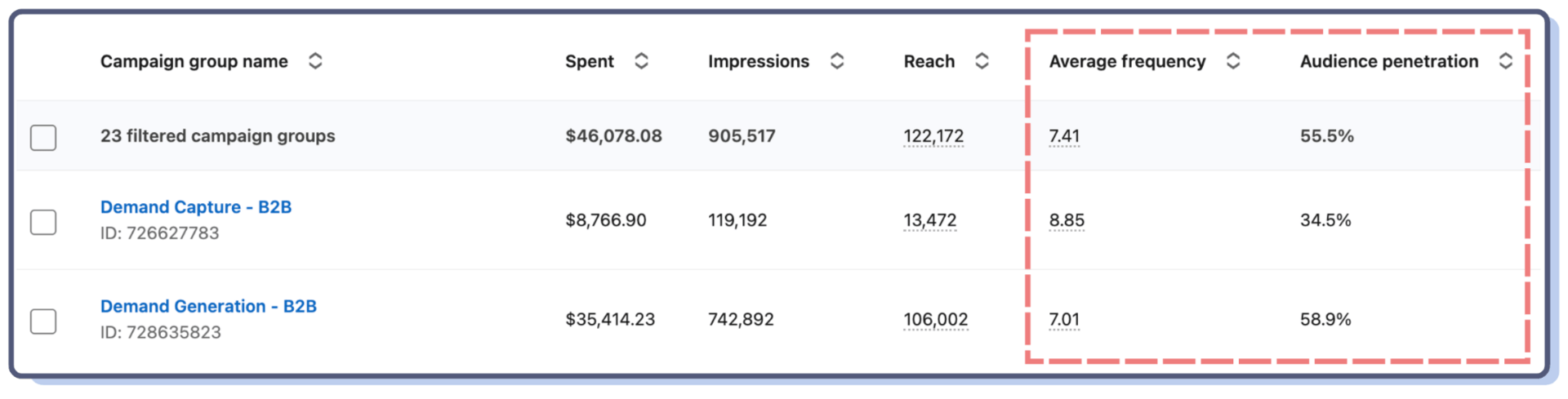

For LinkedIn, look at audience penetration and frequency over 90 days.

Below 80% penetration and 10 frequency means you have room to scale. You can put more spend in, reach new prospects, and build potential pipeline in the future.

Above 80% penetration and 10+ frequency? Pushing more spend into LinkedIn probably isn't going to get you solid ROI.

What your frequency + penetration % will look like inside Campaign Manager

Once you hit these targets, LinkedIn is just going to spend your money while increasing frequency, which means it's not getting in front of any new prospects. That's the signal it's time to start thinking about some new segments or potentially new channels.

Start with 60:40 budget split weighted to LinkedIn as it has lower CAC over time, more scalable audiences, and the ad spend ROI compounds.

We created a custom formula we use on every client account to make sure their demand generation goals are achievable with their budget. The Reach Ratio™️ calculation scales frequency requirements based on your actual audience size.

The reason I recommend this strategy:

LinkedIn has lower CAC, it's more infinitely scalable because you can always experiment with new audiences up to a point, and LinkedIn also compounds over time more than Google does.

Google is really going after in-market prospects, whereas LinkedIn is building those memory structures so that prospects who aren't in-market right now think of you when they move in-market in the future.

Stick To The 95:5 Rule on LinkedIn

Only 5% of B2B buyers are in-market today. But 95% will be at some point. If they never see your ads, they won't remember you when it's time to buy.

What I recommend: Use LinkedIn For Cold Audiences

Allocate 80% of budget to saturating cold audiences with pain-focused content try to hit the penetration + frequency targets I just recommended.

What that's going to do is increase your luck surface area and get in front of more buyers.

And this does work. We tested it in November with a completely cold campaign to an audience we'd not run ads to before, hit that high audience penetration and frequency target, and ended up getting eight high-intent SQLs from that campaign.

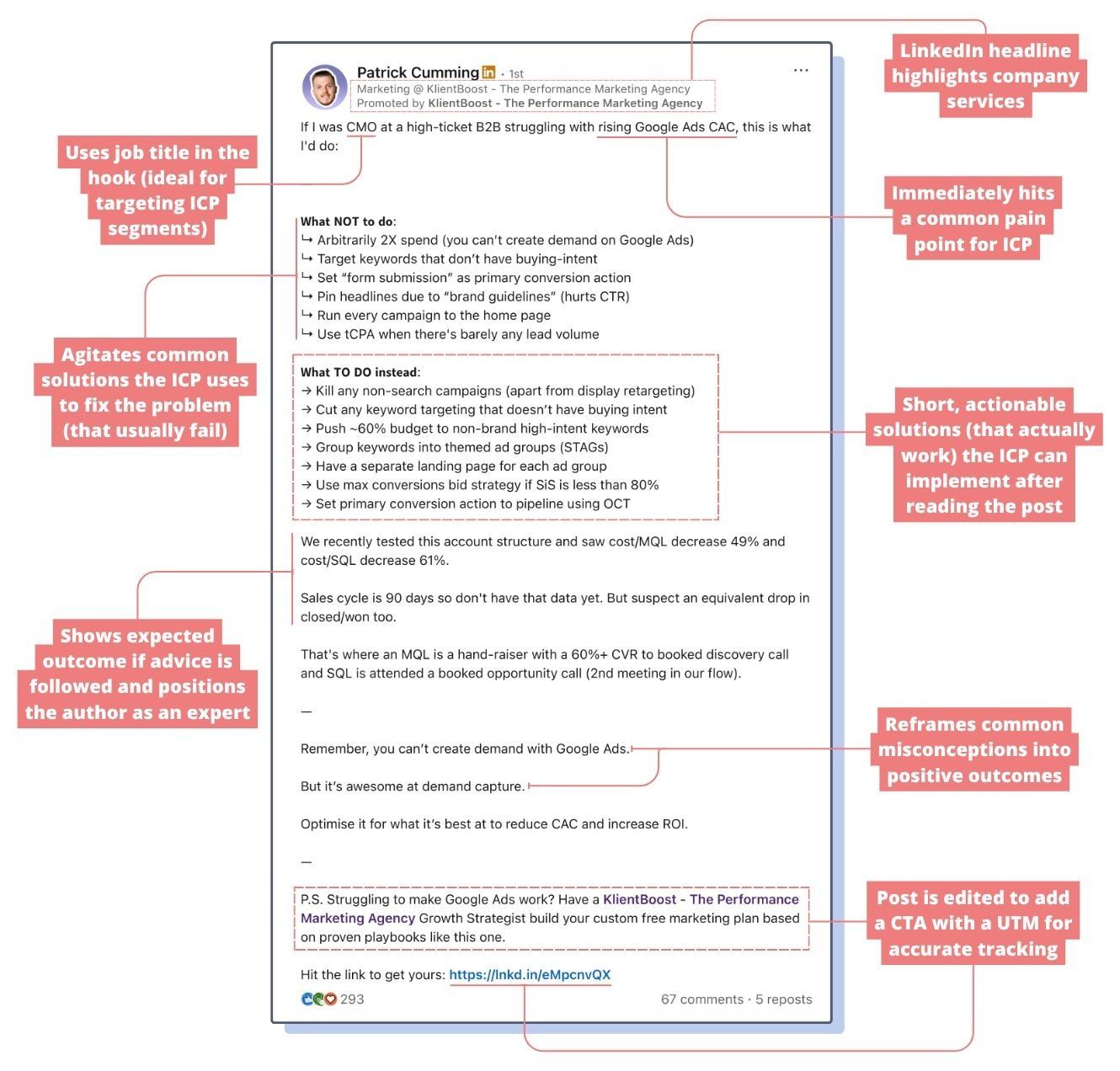

One of my best performing ads for 2025 was this thought leadership ad we ran in our cold layer. It took me 15 minutes to write.

The other benefit is you also hit a large chunk of the audience that's out-market. Over time you're going to see that these ads actually start converting from quarter to quarter to quarter.

An example: we still have ads that we launched in January last year getting attributed closed revenue even now, over 12 months later.

What I recommend: Target in-market buyers and existing pipeline

It's very difficult to target in-market buyers specifically—it's hard to know who's in-market and who's out-market. But there are some signals you can use.

Tools like Vector are really good at looking at common signals like job changes, recent investment rounds, and piping those audiences into your platform.

In terms of first-party data you have available, retarget any high-intent page visits like product pages, feature pages, capability pages, pricing pages, and demo pages.

And for the love of God, definitely target existing pipeline.

I've worked with so many companies where as soon as the lead moves into the SQL phase, they exclude it from targeting.

These are the most important audiences to target because they're the ones closest to a purchase decision. The deal is not won until the deal's won, and there's lots of data out there from top players in the B2B space showing that targeting pipeline increases close rates and increases average contract value.

Measure What Matters (And Be Realistic About Sales Cycles)

A quick reality check from our friends over at Dreamdata: The average time from first touch to closed-won is 211 days. First LinkedIn impression to revenue is 320 days. MQL to SQL stage alone takes 107 days.

Selling to larger companies? Add 50% more time. Enterprise journeys average 315 days.

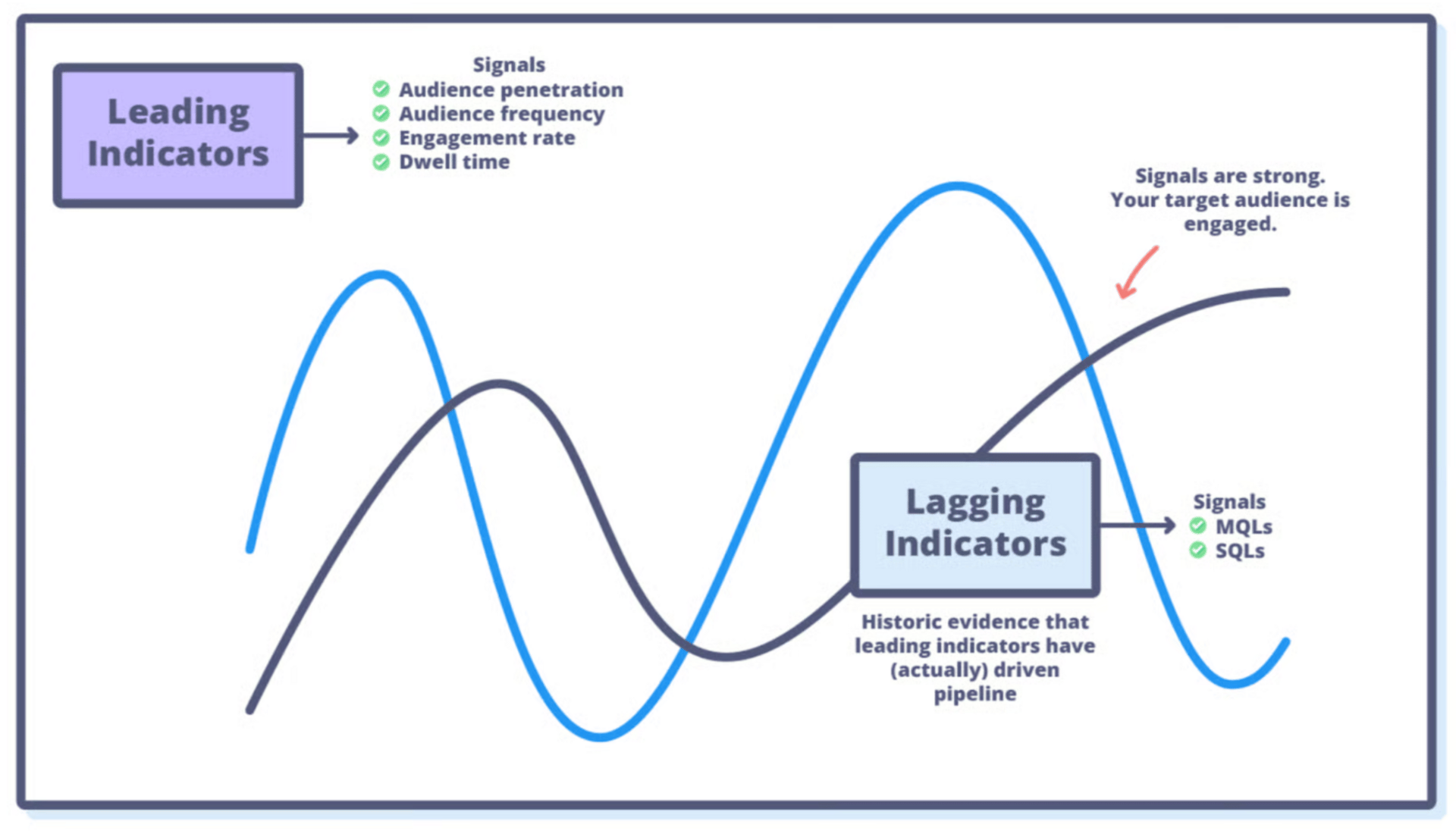

To measure all this, I recommend you use some leading indicators to start with.

On the LinkedIn Ads side of things, look at where audience penetration, frequency, dwell time, and engagement rates are trending.

Typically the ads that have the lowest cost per 1,000 member accounts reached should be your priority. Cost per 1,000 member accounts tells you how cheap it is to reach a unique user, and with demand gen campaigns it's much more important to reach more unique users, so that's really what you want to be optimizing for.

If you’ve followed the steps correctly, I would expect after 90 days that you do have some pipeline coming in.

After 90 days:

Cut anything with 2X higher CAC than average and push 80% of spend to what's left

Use 20% to test new campaigns

Track cost per 1,000 accounts reached, engagement rate, and dwell time on your content

But as always, pipeline data beats everything.

You need be in the platform looking at the conversions coming in and seeing which ads are actually driving pipeline and closed revenue.

If you do this, I promise you will be way ahead of most of your competitors before Q1 closes out.

Most B2B SaaS teams will keep doing what they've always done: launch campaigns fast, skip the setup, blame the platform when it doesn't work.

But if you build the foundation first with tight targeting, proper attribution, long conversion windows, diversified creative, your CPMs will drop, CAC will stabilize, and you'll actually know what's working.

Just get that house in order before you scale.

Hope you've found this useful, and I’ll catch ya in the next one! 🤘

Patrick

P.S. If you are a SaaS marketer spending more than $20K/month on LinkedIn or Google and your CAC is trending up while lead quality trends down, hit me up. I'd love to audit your account, show you exactly where the waste is, and share some tips on how to run an account that brings in revenue… just send me a DM to chat!