Hey friend,

If vibes over on LinkedIn are anything to go by, the story for most marketers this year is shrinking budgets with increased pipeline targets.

But I want to throw in a quick reality check on how hard this will be. Based on the data I’m seeing, LinkedIn Ad CPMs have increased 28% YoY and Google Ads CPCs are up 29% vs this time last year.

And yet, I still see accounts throwing $15K at LinkedIn, $25K at Google Ads, and $5K at Meta… hoping that something sticks.

This vibe-y approach to a paid ads program fails because, for the budget to work, spend allocation must be based on:

What is generating pipeline most efficiently

What channels are actually scalable

After running budget planning across hundreds of B2B accounts, I know exactly why this keeps happening. And it's the #1 problem I see for paid ads programs that miss pipeline targets: marketers are scared of missing out on buyers, so they try and target everyone.

If this resonated with you (and you want to fix it), here’s what I recommend👇

B2B Brands Are Suffering From Audience FOMO

I am going to coin a new term this week, but it’s justified: Audience FOMO.

Audience FOMO is the irrational fear of missing potential buyers if you don't target everyone. This leads marketers to spread insufficient budgets across audiences too large to reach effectively.

It also massively impacts the competitiveness of your paid ad program across every channel.

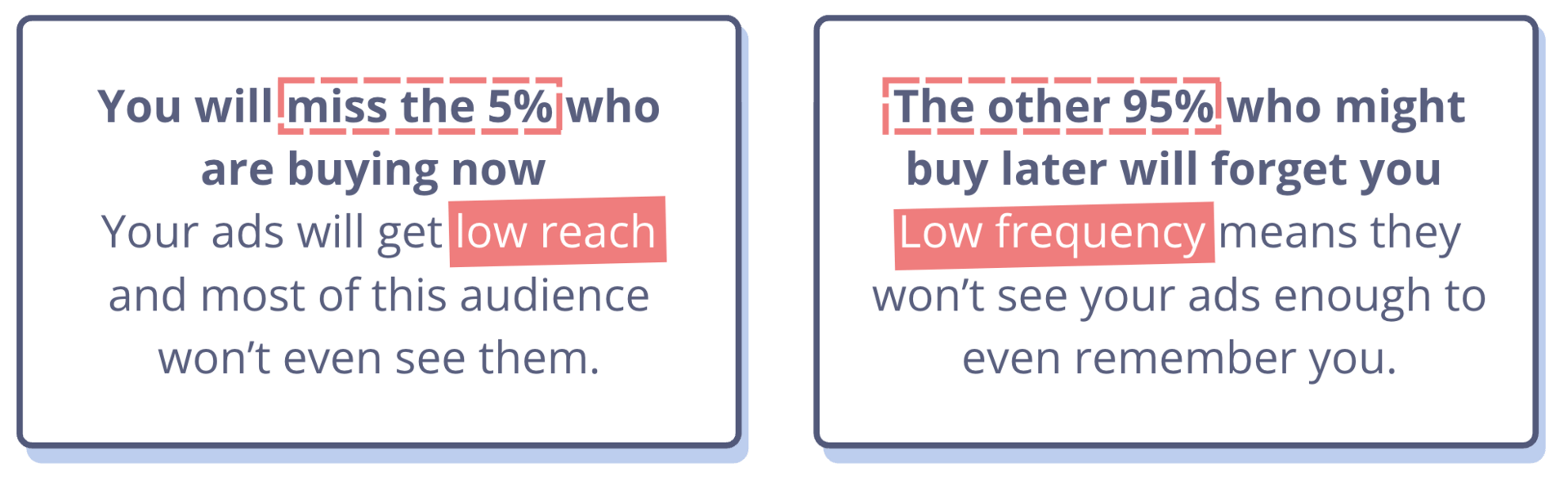

You’ve heard me say it before, but I’ll repeat it before I get to my next point: only 5% of your audience is in-market to buy, the other 95% isn’t. But they might be down the road.

This means two things:

You need high frequency to stay top-of-mind for the 95% who will eventually move in-market

You need high reach to maximize your odds of hitting the 5% who are in-market right now

The problem with paid ads is, it's almost impossible to know who the 5% are.

Audience FOMO lures marketers to target way more buyers than they can afford. So, unless your brand is throwing millions into monthly ad spend, your entire paid marketing engine will underperform.

What happens when your paid ad program is hit with audience FOMO 😬

Here’s how it shows up across the two main B2B channels:

On LinkedIn Ads. Audience FOMO ends with marketers targeting huge audiences with painfully low reach and frequency. I see accounts go after 500K people with $10K/month spend and reach maybe 15% of them at 2-3 frequency

On Google Ads. It manifests differently. B2Bs try to target more keywords than their budget can handle, which makes them less competitive in every single auction.

So, what can you do about it? 🤔

Step 1. Get Brutally Honest About Your Budget

Before you touch your LinkedIn or Google Ads, I want you to answer a very important question: Can you actually afford to reach the audience you currently target?

Most B2Bs skip this step, launch campaigns with a generic budget number and hope for the best. But you must build comprehensive reach to have a shot at competing in the current marketing environment.

Comprehensive reach is when you hit a significant portion of your audience with enough frequency so they remember you. For B2B, that's 80% audience penetration at 10+ frequency over 90 days.

High penetration catches the 5% of in-market buyers you need for short-term pipeline, while high frequency builds mental availability with the 95% who'll buy later.

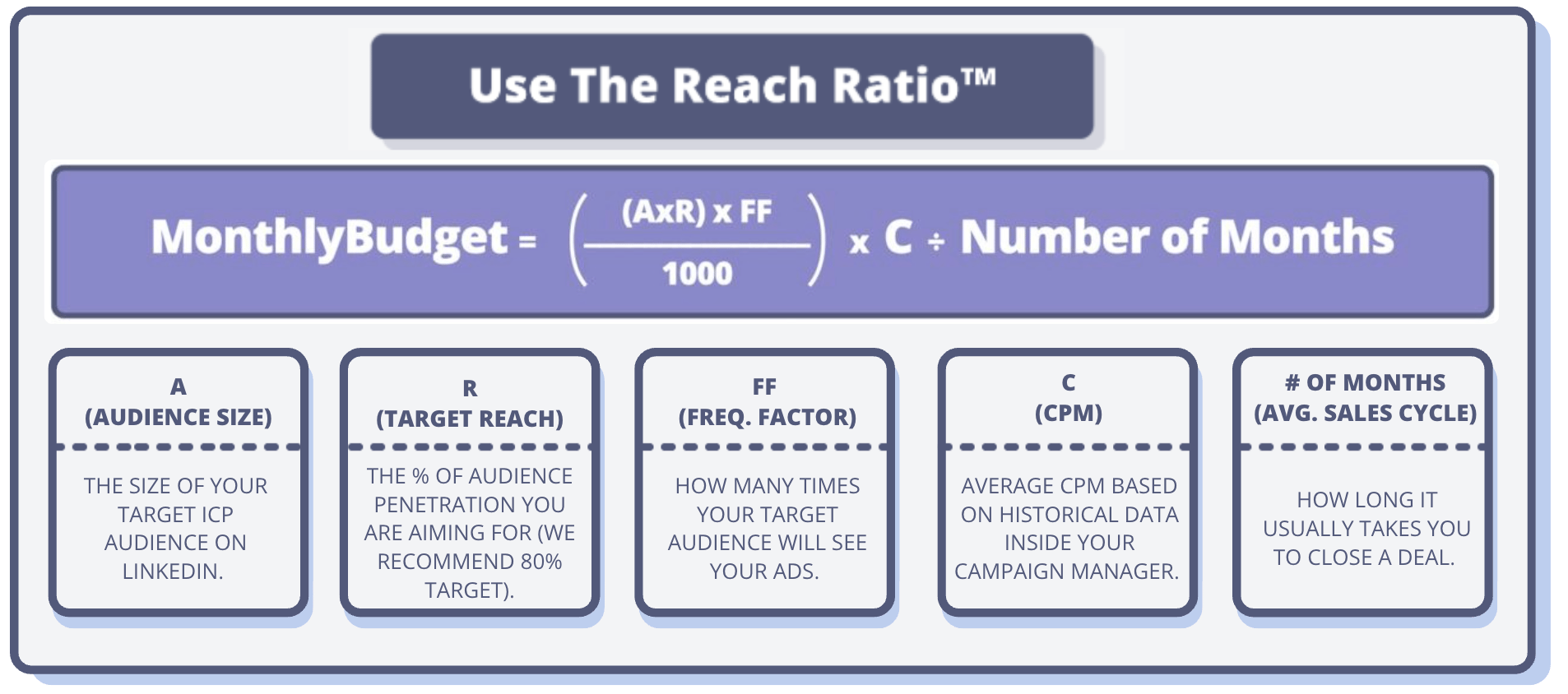

We developed a custom Reach Ratio Formula to help B2Bs calculate how much budget they really need to meet these targets.

It looks scary… but it works!

When you're brutally honest upfront, you avoid three months of burning budget on campaigns that were mathematically doomed from the start.

Let’s take a look at how to use it.

Step 2: Hit Reach + Frequency Targets On LinkedIn Ads

Go to Campaign Manager → Audiences, and then check your forecasted audience size to see LinkedIn's estimate.

Look for this box in the right hand corner of your campaign

Let's say the target audience size is 250,000. Use our Reach Ratio Budget Planning Tool to calculate whether your budget can hit 80%+ audience penetration and 10+ frequency over 90 days.

If your CPM is $45, the calculation tells us:

(250,000 × 0.8 × 10) ÷ 1,000 × $45 = $90,000/quarter (or $30K/month)

If you have $30K/month, you have a good shot at hitting the reach and penetration targets to achieve comprehensive reach. But, if you only have $15K/month, you just can’t afford to target 250k people effectively.

This is when it dawns on most marketers that their paid program is painfully under-budgeted.

The options:

Increase budget (not realistic for most marketers)

Shrink the audience until the math works

Yes, shrinking your audience means you'll exclude some potential buyers. But, concentrating budget on a smaller audience means you can reach 3-4x more people within that group at a meaningful frequency.

This dramatically increases your odds of capturing in-market buyers.

🤔 A quick note on frequency: You might be thinking "won't people get annoyed seeing my ads 10+ times?"

The answer is no. If you run the ad over 90 days and diversifying creative formats, it's not the same ad they will see over and over. It's different messages and different formats over three months, which is exactly how good brand building works!

Step 3. Rank Your Google Ads Keywords by CPA

On Google Ads, the same principle applies: concentrate budget where it's most efficient.

Go to Campaign Manager → Keywords → Columns → Modify → Add "Conv. Value/Cost" and "Search Impression Share" to see where you stand here.

Pull this data at the keyword level and export to a spreadsheet. Then:

Rank keywords by pipeline acquisition cost (or opportunity cost, or SQL cost… whatever maps to revenue for you)

Cut keywords significantly above average, typically 2X higher cost or above

Calculate the budget needed to maximize search impression share on your remaining high performers using CPC data

If your budget can't hit high search impression share on every keyword, progressively remove those with the highest acquisition costs until the math works.

The goal here is to run a lean list of keywords with the highest likelihood of converting to pipeline.

We did this with a prospect recently who had been spending $8K/month on 15 keywords that generated zero pipeline. We found:

6 keywords with $20-50 acquisition costs had 10% search impression share

They were losing 9 out of 10 auctions on their best performers because budget was spread too thin across other targets

After cutting the waste and reallocating budget to more impactful keywords, we project a 40% drop in CPA within 60 days. Stay tuned! 👀

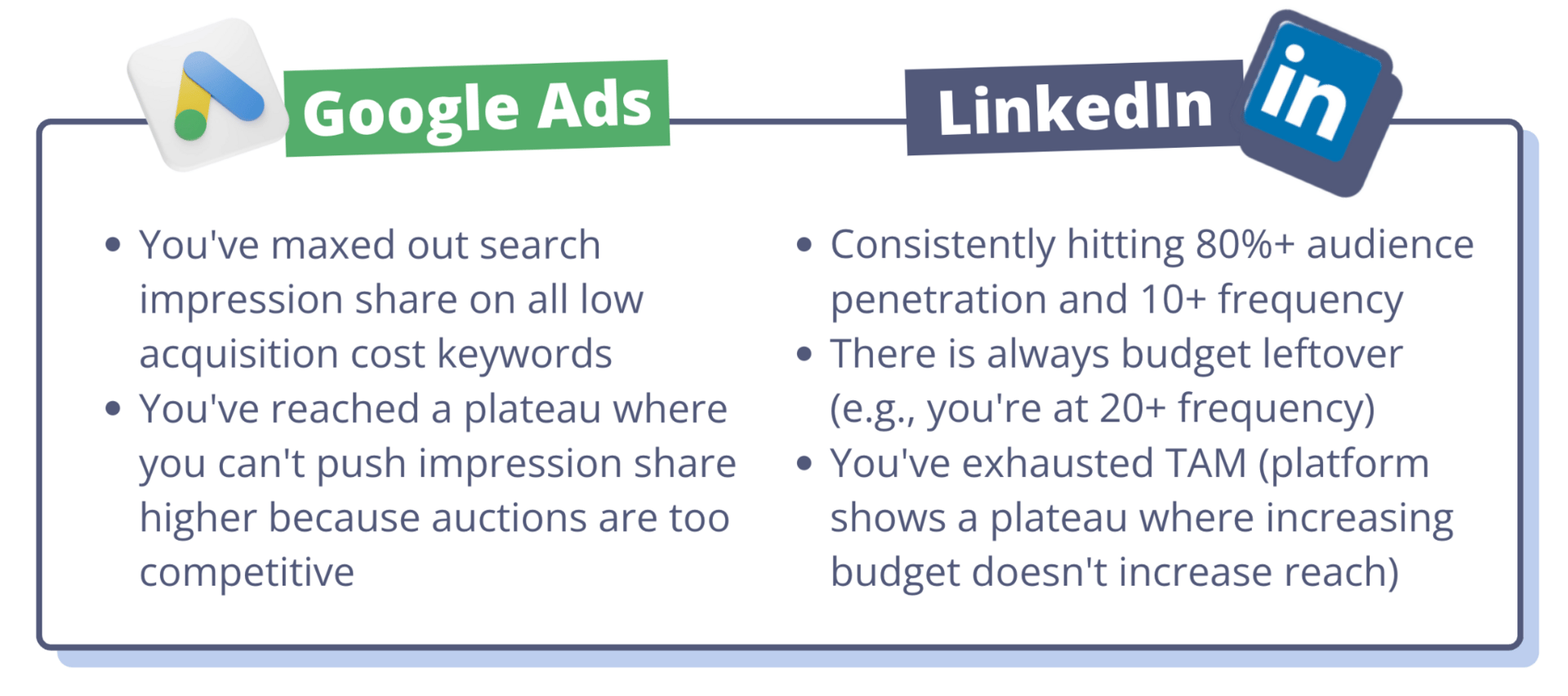

Step 4. Ignore Channel Expansion Until You Max Proven Channels

Ads are getting more expensive. I see a lot of B2B marketers investing in traditionally B2C channels like Meta Ads and Reddit Ads because they offer cheaper CPMs.

The logic makes sense, but the execution to make this play valuable from an ROI perspective is usually way off. That’s why I recommend you only do this if you are hitting these targets:

Then (and only then!) should you test new channels.

And if you do expand into Meta or Reddit, use third-party tools like Primer or Vector to build your ICP audiences. I wrote more about how to do this in a recent newsletter, check it out here.

How To Put This Plan Into Action

If you run your paid ads program 👇

Pull your current audience size and forecasted reach from LinkedIn Campaign Manager

Use the Reach Ratio tool to calculate if you can hit 80% reach and 10+ frequency with your current budget

If not, shrink your audience by tightening job titles, seniority levels, or company filters until the math works

For Google Ads, export keyword performance data and rank by acquisition cost

Cut the bottom 50% of keywords by efficiency and reallocate budget to winners

If you manage an agency/consultant running your paid ads program 👇

Ask them what your current audience size, reach percentage, and frequency is across your campaigns

Request a budget allocation map showing spend vs. pipeline acquisition costs by channel and segment

See how confident they are around hitting 80% reach at 10+ frequency with your current budget and audience size on LinkedIn Ads

Ask them to run a Google Ads audit to flag any keywords or audiences generating zero pipeline, and then prepare a reallocation plan if they find any

Set a monthly reporting cadence on reach, frequency, and cost per opportunity (and if they are just reporting on vanity metrics right now, that is a red flag!)

If they can't answer these questions or push back on the benchmarks, think about looking for another partner that will help you compete this year! 😏

This Plan Is The Best Way To Maximize Budget For Pipeline In 2026

Whether it’s fair or not, your budget for 2026 is almost certainly locked in at this point.

Pipeline targets aren't going down. Ad costs aren't going down. The only lever you have left to pull is to efficiently allocate your spend to maximize ROI.

If you use the Reach Ratio to concentrate budget where it's most efficient, you'll:

Hit higher reach and frequency on your core audience

Generate more pipeline per dollar than your competitors

Cut acquisition costs

Hope you've found this useful, and I’ll catch ya in the next one!

🤘

Patrick

P.S. If you're spending more than $20K/month on LinkedIn or Google Ads and you're not sure if your budget allocation is efficient, hit me up for a free marketing plan. I'll run the Reach Ratio math and show you exactly where budget is being wasted and how to reallocate it for maximum pipeline 🤝