👋 I held a session with Fibbler’s Adam Holmgren this week on how to prove marketing works to execs. We covered:

Attribution gaps in modern marketing

How to use influenced attribution to show how your buyers really buy

The way I tell a compelling marketing story to execs using attribution data

Hey friend,

I want to talk about the elephant in the room of paid search.

Most B2B SaaS companies put a big chunk of their Google Ads budget into brand protection campaigns. It’s just one of those things that “you do” when you run a paid search program, right?

If you take one lesson from today’s newsletter, I hope it’s this: Brands waste around $11 billion/year on branded search campaigns for “protection”, even with no real competition in the auction.

I call this the Google Tax. Putting budget into a strategy we’ve been told just “do” even when branded terms rank organically.

So… do you really need to pay the Google Tax?

Here’s the playbook to run to find out 👇

We’ve Normalized Paying The Google Tax

"Our competitors are stealing our clicks on Google Ads. We need to protect our brand."

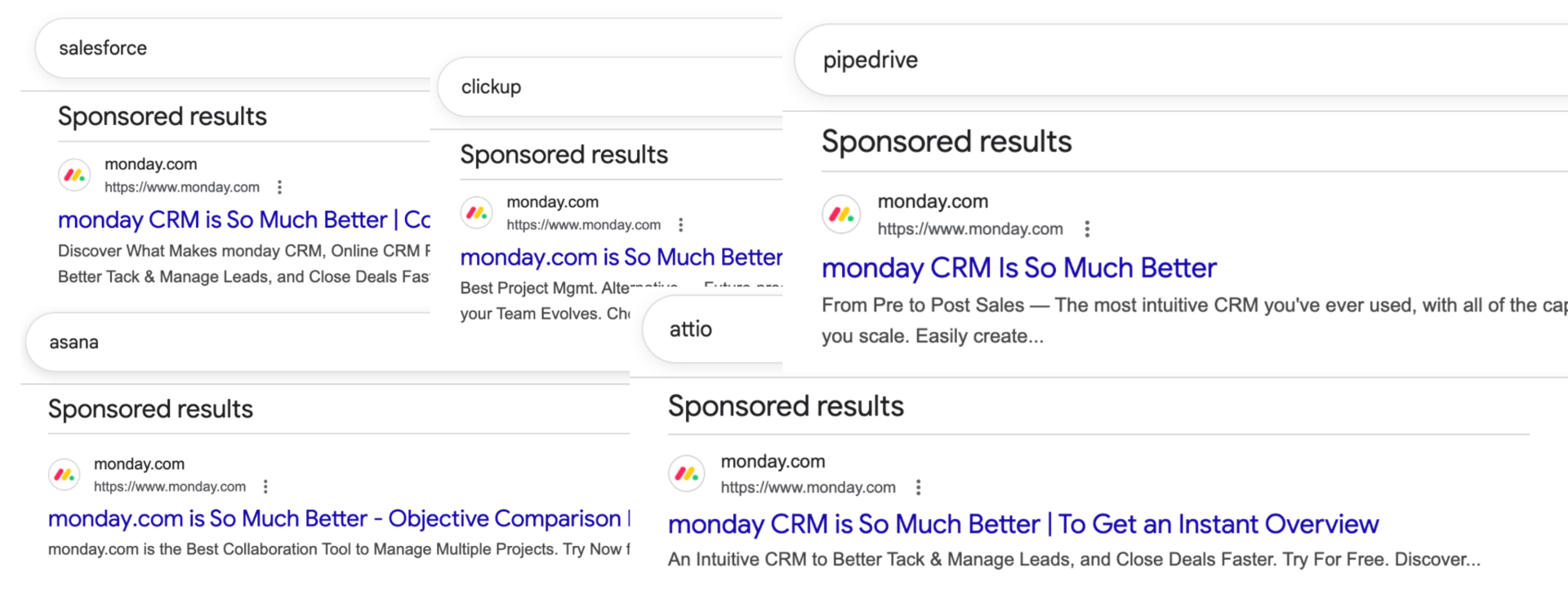

I hear this on nearly every single call I have with a client. And I understand why. If you type your brand into Google and see a bunch of competitors trying to steal prospects, it can be a concern.

Duly noted, LinkedIn. Duly noted.

This is where my advice veers away from the standard paid search playbook. We pay for branded search ads we’ve never needed to pay for. This is a hangover from the Google Tax.

Over the years, Google has systematically introduced features to drive up branded CPCs.

Recently, it's been AI features like Performance Max and AI Max. Before that, Local Service Ads started appearing on branded queries. And let’s not forget broad match + Smart Bidding that expose branded terms to more noise and clicks.

If there’s anything Google hates, it’s a keyword with no competition. And your brand is an auctionable keyword.

How else would they collect their Google Tax? 😏

18 months ago, I put my suspicions to the test and killed our brand protection campaigns.

Our pipeline didn’t drop, not even a little.

Those branded searches just converted through organic instead because when someone searches “KlientBoost,” they want KlientBoost.

Test To See If Your Branded Campaigns Are Worth It

I'm not suggesting you read that example and completely shut off branded search campaigns. But you should at least test it.

Here’s what I recommend 👇

Option A: Run a Full Go-Dark Test

This is exactly what it sounds like. You cut the power to all branded campaigns and see what happens:

Pause spend on all brand campaigns for 2–4 weeks

Measure what happens to holistic pipeline (total demo requests/SQLs etc from ALL sources in your CRM, not just Google Ads conversions)

Pull your total KPI for the test period vs. the same period the prior month

If pipeline numbers hold steady, your brand “protection” ads were just cannibalizing organic

If the test is successful, take that reclaimed budget and redirect it to high-intent non-brand keywords where you can actually reach new buyers.

Option B: Geographic Split Tests

This is a lower-risk go dark play that shuts off branded campaigns in specific areas.

Pick a bunch of geos where you have at least 50+ monthly branded searches

In your campaign settings, scroll down to "other settings” and click the Locations dropdown. Type in the geos you want to exclude. You can exclude up to 120 countries, states, cities, and even postal codes in each campaign

Run the test for 4 weeks minimum

Compare pipeline-per-branded-search in the paused regions vs. active regions using offline conversion data

When we run these “go dark” tests on client accounts, we consistently find that traffic just shifts to organic without any pipeline loss.

Option C: Switch Brand Campaign Bidding Strategy

If you can’t stomach switching off brand campaigns, tweak your bidding strategy to get more control over how Google spends your budget:

Switch from Smart Bidding to manual CPCs

Set bids at 25–50% of your current average brand CPC. You’ll still show up for most uncontested queries but won’t overpay when Google inflates the auction

Track incrementality and attributed revenue and kill branded campaigns the moment they stop earning value

The lesson here is to stop treating brand protection as a "must-have" and start treating it based on actual competitive pressure.

Forget About Targeting Competitors

While we’re on the topic of brand protection, let’s talk about competitor keyword campaigns.

A ton of B2B SaaS brands spend budget bidding on competitor brand names, thinking they’ll steal market share with clever copy.

I respect the commitment. I would love to see the ROI.

I’ll add a caveat: This strategy can work when a category is younger and less mature, or when buyers don’t have a preferred brand yet.

But for most B2Bs, it’s one of the highest cost per pipeline campaign types you can run.

I audited an account a couple of weeks ago that was spending 50% (!) of their total search budget on competitor campaigns. They had a 10x higher cost per demo than their non-brand campaigns, which were only getting 10% of the budget.

Without making any structural changes to the account, we could easily quadruple ROAS by moving budget from competitor campaigns into high-intent non-brand keywords.\

How to evaluate your competitor campaigns 👇

Pull the data. In Google Ads, filter your campaigns to show only competitor-targeting campaigns. Add columns for offline conversion metrics you track: e.g cost per SQL, cost per opportunity, cost per closed/won. Compare these to your non-brand campaigns side by side.

Shift budget with math. If competitor campaigns have higher cost per SQL than your non-brand keyword campaigns, start shifting budget away from them to max ROI. Shift a chunk (20-25% at a time) of competitor campaign budget into your top non-brand campaigns.

Monitor visibility. Once you start shifting budget, monitor impression share on those non-brand keywords. If it climbs and cost per SQL stays stable, keep shifting. Most accounts can fully exit competitor campaigns within 4–6 weeks without pipeline disruption.

Look for this column inside your Google Ad campaign to see impression share %

Measure revenue attribution. Even if competitor campaigns convert to pipeline, check if they convert to revenue. Competitor keywords can generate demos, but those leads have significantly lower close rates because the prospect was already in the decision-making phase with your competitor. Pipeline without revenue is still a waste of budget.

On the revenue attribution side, it really helps to have offline conversion tracking in place.

If you don’t, compare cost-per-lead for competitor vs. non-brand campaigns and ask your sales team which source produces higher-quality conversations. It’s not perfect, but it can help with directional attribution.

💡 I highly recommend getting offline conversion tracking set up if you don’t already to measure revenue. I walked through how to do it last week 👇

Start Playing Offense On Google Ads

If you run these tests and shift some budget around, you have a much better shot at competing for those high-value ICPs you are hunting on Google.

You’ll also stop wasting budget budget on:

Unnecessary brand campaigns with no competition in the auction

Competitor campaigns with 10x higher CAC

Every dollar you save with structural fixes is a dollar you can reinvest into proven, high-intent keywords that drive pipeline.

The real fight on Google Ads isn’t for your brand name. It’s for the non-brand keywords where buyers don’t know you exist yet.

That’s the path to stop paying the Google Tax and maximize paid search ROI.

Hope you’ve found this useful and I’ll catch ya in the next one!

🤘

Patrick

P.S. If you’re spending more than $10K/month on Google Ads and want us to audit your account to if your brand protection and competitor campaigns are worth it, hit me up.

We’ll show you exactly where to cut waste and which non-brand campaigns to double down on the improve the ROI of your paid search program. Book a call with our growth strategists to get started 🤝